Can Housing Developer App Boost Property Sales?

According to the Real Estate & Housing Developers' Association (REHDA) Malaysia, there are over 1,000 developers across Peninsular Malaysia, and they are responsible for some 80% of the total real estate built in this country. In recent years the call for digital transformation was brought with the Fintech that refers to Financial Technology; Proptech is the term we used to refer to Property Technology. When Fintech more often competes with traditional financial institutions in delivering financial services, PropTech players usually act as partners by supplementing rather than competing with the housing developers.

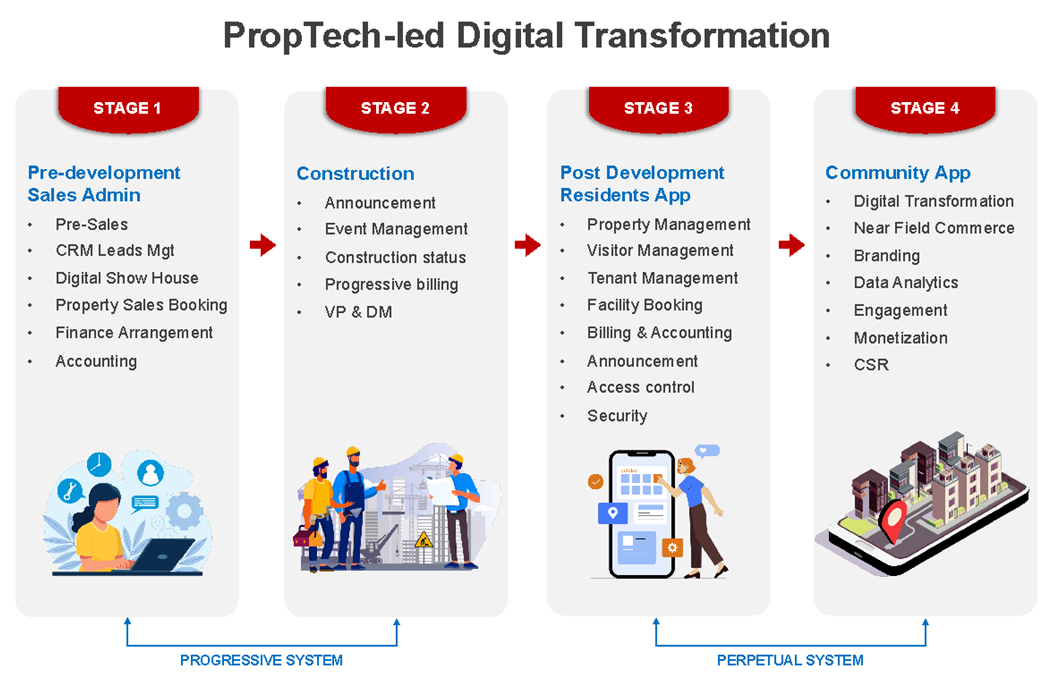

PropTech comes in as scattered components because real estate development is a progressive process in stages that comprises pre-development, construction, and post-development, intermingled with sales and marketing activities.

Administration System to Operation System

In general, PropTech transformed the used-to-be administrative system used only by a few administrators to serve a more extensive user base. As a result, PropTech has to come with different modules in different stages throughout the development timeline. In terms of segmentation, PropTech that serves a larger user base can be sales and admin module, lead/CRM system with booking management for presales; and S&P signing to post-sales finance and administration module to keep house buyers updated. A development module probably needs to engage buyers by updating the construction statuses, progressive billings and more, until the property is ready to be possessed by house buyers and clearance of defects. Only then will the entire housing project (if strata-titled) be handed over to JMB (Joint Management Body). And this is where the progressive process stops, and the real estate developer considers its mission accomplished.

Since PropTech is a complex system, I focus solely on the Developer App, which is a customized system typically outsourced to PropTech providers, with the purpose to promote their properties and branding, to engage customers etc. Therefore, the standard PropTech system, mainly in the SaaS model available in the market, will not be discussed in this article.

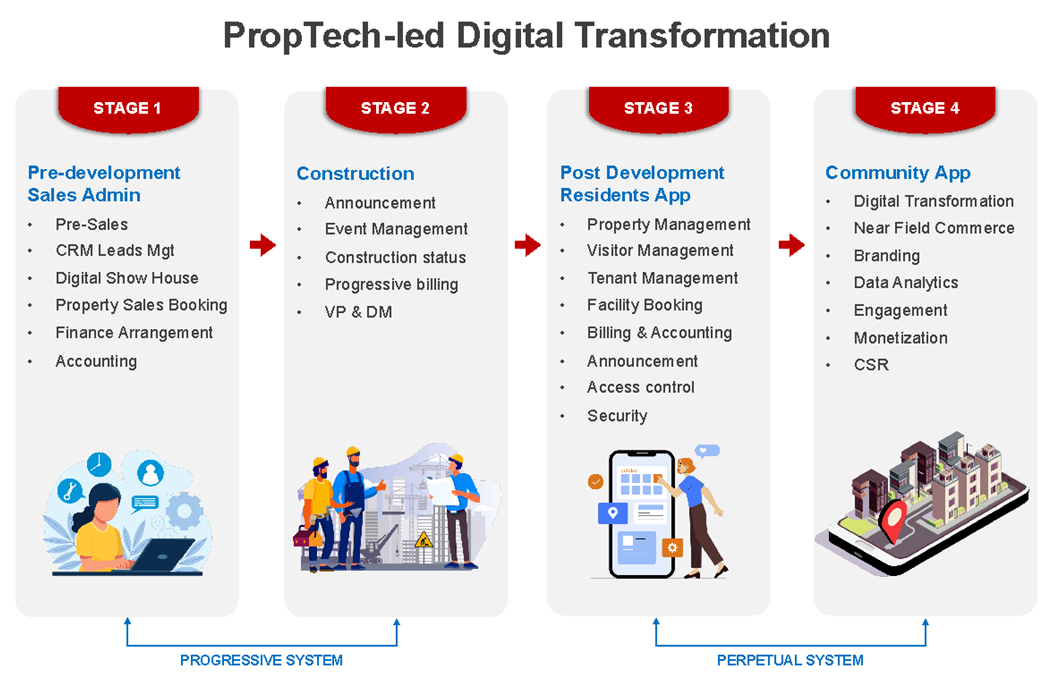

I pick a handful few Developer Apps here and compare their features to summarize them in the table below:

Summary

1. Almost all Developer Apps are focused on promoting their properties as their primary objectives.

2. Among the 11 Developer Apps, two are plugged in with the smart residential system to handle daily property operation (Special login for residents), and 1 (IOI Community) is a purely operational smart residential App.

3. Many Developer Apps are built with VP (vacant possession) and defect management systems.

4. The commerce module provided by a few developer Apps is still quite basic.

* As a mixed development project, i-City develops its App to serve its entire community ecosystem with QR pays well. As of 7th December 2021, most icons are still beta, stuffed with information and inquiries only.

Note: The study is based on the superficial features available in the Apps without a detailed examination. Even if two apps have the same features, it doesn’t mean that both are equally providing full functions or delivering the same user experience. In addition, some of the modules like Smart residential, VP and defect management are not available for the public to try, only limited to the house buyers.

I must admit that there is no definitive scope for a Developer App because it is mainly customized to fulfil the developers' requirements. Generally, it is up to the developers to decide the scopes and the main objectives of their apps. And for the property listing features offered by almost all apps, we can assume that most developers emphasize sales and marketing.

However, I'm in doubt of the result for the following reasons: House buying is not like ordinary shopping; only approximately 10% of house buyers invest in more than one property throughout their whole life. When house buyers shop around, they probably rely on more online property platforms such as iProperty or Property Guru to search for their ideal properties, rather than the individual Developer App with limited choices. This point can be proven by the Android installs of 500k+ for iProperty and PropertyGuru, and only around 1k+ up to 10k+ Android installs per Developer App. Some Developer Apps provide virtual show houses for potential customers to have a better browsing experience. But the experience would be better on a larger screen PC than on a smartphone.

And, if 90% of house buyers can only afford one house and no recurring purchase in their entire life, all the marketing incentives like rewards, wish lists, or promotions make no difference with or without an app.

Indeed, the marketing module can stay but shouldn't be the priority.

Indeed, the marketing module can stay but shouldn't be the priority.

Priority on Operational Module

Developer Apps are more useful if the objective is to target the post-sales activities by enhancing the operational module to elevate user engagement. Once the S&P Agreement is sealed, operational features like progressive billing, construction update, news and announcement, event booking, vacant possession and defect management would be helpful to foster a closer tie with house buyers. After that, the developer can introduce an integrated smart residential community platform to the owners. The digital platform consists of visitor management, facility booking, billing, accounting, tenant management and more; in short, a digital property management system.

It is apparent that real estate developers value data; hence, they are not hesitant to jump onto the digitalization bandwagon. However, when we thought they were supposed to embrace all the above, in contrast, most developers will stop at the Defect Management module after the property is handed over to the house buyers. Even if some developers help the new communities jumpstart an integrated smart residential community platform when the JMB (Joint Management Body for the strata-titled) is formed, whether the JMB continues to subscribe to the system is no longer the concern of the developer. Their digitalization abruptly ends here.

As such is the nature of the developer's business. When a project is completed, the warranty is over; they will move on to a new project. Because they don't see that continuing the digital platform justify their return or help them survive in the everchanging digital era. Or, they don't see that reinvesting in digital transformations could help them harvest new business models, especially when the benefits from data mining for future monetization is still far from reach.

Progressive System to Perpetual System

I summarized the PropTech-led digital transformation in the illustration below to ease understanding.

Developer Apps are more useful if the objective is to target the post-sales activities by enhancing the operational module to elevate user engagement. Once the S&P Agreement is sealed, operational features like progressive billing, construction update, news and announcement, event booking, vacant possession and defect management would be helpful to foster a closer tie with house buyers. After that, the developer can introduce an integrated smart residential community platform to the owners. The digital platform consists of visitor management, facility booking, billing, accounting, tenant management and more; in short, a digital property management system.

It is apparent that real estate developers value data; hence, they are not hesitant to jump onto the digitalization bandwagon. However, when we thought they were supposed to embrace all the above, in contrast, most developers will stop at the Defect Management module after the property is handed over to the house buyers. Even if some developers help the new communities jumpstart an integrated smart residential community platform when the JMB (Joint Management Body for the strata-titled) is formed, whether the JMB continues to subscribe to the system is no longer the concern of the developer. Their digitalization abruptly ends here.

As such is the nature of the developer's business. When a project is completed, the warranty is over; they will move on to a new project. Because they don't see that continuing the digital platform justify their return or help them survive in the everchanging digital era. Or, they don't see that reinvesting in digital transformations could help them harvest new business models, especially when the benefits from data mining for future monetization is still far from reach.

Progressive System to Perpetual System

I summarized the PropTech-led digital transformation in the illustration below to ease understanding.

To boost the usefulness of the Developer App, the entire flow from progressive to the perpetual system across the four stages from pre-development, construction, post-development and Community-focused should be more operational-oriented instead of marketing-oriented. Its marketing or commerce value will emerge when the time is ripe.

Based on the chart we recite, mainly the existing Developer Apps cover Stage 1 & 2 but are marketing oriented, a few are extended to Stage 3, and only two Developer Apps arrive at Stage 4 with some Community App elements but still lack depth.

Three Challenges for Developer Apps

I listed three challenges for Developer Apps:

Challenge 1

Based on the chart we recite, mainly the existing Developer Apps cover Stage 1 & 2 but are marketing oriented, a few are extended to Stage 3, and only two Developer Apps arrive at Stage 4 with some Community App elements but still lack depth.

Three Challenges for Developer Apps

I listed three challenges for Developer Apps:

Challenge 1

How to increase the practicality by enhancing the operation modules for Stages 1 & 2?

Challenge 2

How to justify the cost to turn the Resident App into a long-term free digital platform for the neighbourhood at Stage 3?

Challenge 3

How to enlarge the App's scope from serving the resident to a larger public within the vicinity at Stage 4 and justify the cost?

Challenge 1 is relatively simple because many PropTech solutions are out there for grab.

Challenge 2 and 3 are actual tasks. To justify the cost of providing a free digital platform to JMB requires budget planning in a very early stage. For example, if the developer set aside an extra RM1,000 for a unit house price, the subscription can last 40 years be based on the market price of the current smart residential platform. Or, for a high-rise condominium that plans to install an intercom system, since the smart residential platform has such capability that saves the developer, the developer may channel the fund to the long-term payment for its subscription fee.

With the long-term operational system subscription cost resolved, then only developers can have a long-term digitalization plan and continue to take on Challenge 3 to plan for a practical community module that plugged in with Near Field Commerce, data mining and analytics, and monetization in the long run, serving the residents and even the community by and large within the vicinity.

Challenge 1 is relatively simple because many PropTech solutions are out there for grab.

Challenge 2 and 3 are actual tasks. To justify the cost of providing a free digital platform to JMB requires budget planning in a very early stage. For example, if the developer set aside an extra RM1,000 for a unit house price, the subscription can last 40 years be based on the market price of the current smart residential platform. Or, for a high-rise condominium that plans to install an intercom system, since the smart residential platform has such capability that saves the developer, the developer may channel the fund to the long-term payment for its subscription fee.

With the long-term operational system subscription cost resolved, then only developers can have a long-term digitalization plan and continue to take on Challenge 3 to plan for a practical community module that plugged in with Near Field Commerce, data mining and analytics, and monetization in the long run, serving the residents and even the community by and large within the vicinity.

Suppose a short-term digitalization plan can stretch to a long-term for standard residential housing projects. In that case, it's inevitable for a long-term township or mixed development project to have a proper digitalization plan or a Super App with robust operational modules to accommodate different types of properties such as malls, schools, office towers, and hospitals in the same area. When a digital platform can provide automation, security, access control, near field orders and deliveries without extra costs, offer social network activities within the community, or in short, I stay, I live, I book, I pay, I work, I shop, I order, I browse from an App; it becomes essential for the developer to create an All-in-One App to create a safe and vibrant community and to promote a digital lifestyle that boosts the property value, benefit the users, house buyers and developers simultaneously.

The App journey has just begun, and the possibilities are endless in the digital transformation era.

Watch TimeTec Digital Building Ecosystem and Smart Township Solution for more ideas.

The App journey has just begun, and the possibilities are endless in the digital transformation era.

Watch TimeTec Digital Building Ecosystem and Smart Township Solution for more ideas.

About Author:

Teh

Hon Seng, Group CEO of TimeTec Group of Companies. Prior to forming

TimeTec, Teh led PUC Founder (MSC) Bhd to be listed on MESDAQ (ACE)

market of Bursa Malaysia in 2002. Teh initiated the R&D in

fingerprint technology in 2000, which later developed into a renowned

global brand for commercial fingerprint product known as FingerTec. In

2008, he foresaw the trend of cloud computing and mobile technology, and

over the years, he had strategically diversified and transformed its

biometric-focused products into a suite of cloud solutions that aimed at

workforce management and security industries including smart

communities and digital building system that centered around the cloud

ecosystem. Teh has more than 20 patents to his name, and he is also a

columnist in a local newspaper and a writer of several books.

.jpeg)

3 comments: